AI-generated image of a scammer

By Ifeyinwa Francis

Online platforms are digital services that enable interaction between two or more interrelated users who utilise the service to communicate over the Internet.

These digital platforms are utilised in various fields, including e-commerce, social media, online marketplaces, search engines, and crowdsourcing platforms, among others, to develop systems and attract leads for business growth, brand and product advertisements, and content creation to engage audiences.

Amidst the potential advantages of online platforms, digital scams have also risen. Fraudsters use the internet to disguise or impersonate individuals, organisations, businesses or brands to trap unsuspecting people. These online scammers trick people through masked websites, links, and adverts, to make people reveal their personal information or send money. Such is my story.

I was a Victim

On the eve of the New Year 2025, I received a message from a strange contact on WhatsApp. The individual introduced himself as Daniel from Lagos and promised to teach me to generate money if I would give him 40 per cent of my first withdrawal. “Your first Cash out is 300k,” he said.

Screenshot of the conversation with Daniel on WhatsApp

Daniel asked me, “Which package can you go for because you can only do it once? 3k to add 300k,4k to add 400k, 5k to add 500k. Note: All are 30% payments after the Sportsbet balance is added successfully. (sic)’’. After that, he sent a link to create my account on SportyBet. I paid N5,000.

I was expecting to earn some money and withdraw just as he promised, but after five days, the account remained zero naira. I called him several times, but he refused my calls. I further sent him direct messages, but there was no reply. Then, I realised that I had been scammed.

Just as I was duped, so was Lisa. She explained her experience: ‘‘On January 4, I clicked on an ad by Master Funders that read, ‘Trade gold with master funder core trading challenge! Start trading as low as $25.

“The ad claims to reward and refund its users’ money after depositing $25 on their website. It encouraged interested users to click on the link below. I clicked on the link to Instagram, which took me to a website.

‘‘A form at the bottom of the website requested my name, physical address and email address. After registration, the website instructed me to pick an auction of $5 to earn $10K or any other one of my choices. Once you select an auction, you will be directed to a payout page where you will deposit your money.

“The website is like a game. After the auction, you will either win or lose the challenges. This is a trick to rip people off their hard-earned money. Nobody has ever won the challenge. I later realised it was all lies. We were scammed, and our money was not refunded. I was a victim,” Lisa explained bitterly.

Techniques Used by Online Fraudsters

Online scammers use various methods to dupe unsuspecting internet users. Some of these techniques are briefly explained below:

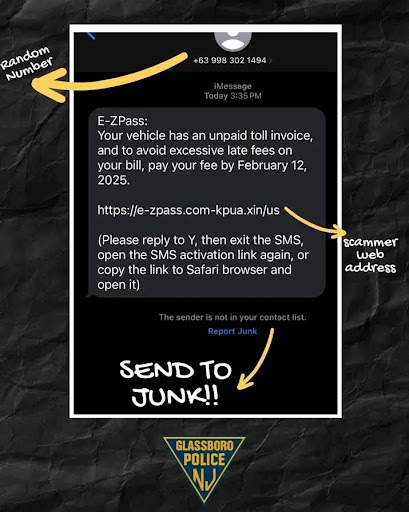

Phishing

Phishing is a type of cyber attack method that malicious actors use to send messages to lure people in and get them to take the bait.

Phishing messages manipulate users and cause them to take actions to install a malicious file, click a malicious link, or divulge sensitive information to access their credentials.

According to the United States Federal Bureau of Investigation (FBI), these techniques are designed to trick people into giving information to criminals.

The FBI stated that through a phishing scam, people can receive an email that appears to be from a legitimate business, asking them to update or verify their personal information by replying to the email or visiting a website.

“The web address might look similar to one you’ve used before. The email may be convincing enough to get you to take the action requested. But once you click on that link, you’re sent to a spoofed website that might look nearly identical to the real thing, like your bank or credit card site, and asked to enter sensitive information like passwords, credit card numbers, banking PINs, etc. These fake websites are used solely to steal your information.”

To avoid falling victim, the FBI suggest that people should remember that companies generally will not contact them to ask for their username or password, advising people not to click on anything in an unsolicited email or text message.

The FBI further suggest that individuals should look up the company’s phone number themselves and never use the one a potential scammer provided. You call the company to ask if the request is legitimate.

“Carefully examine the email address, URL, and spelling used in any correspondence. Scammers use slight differences to trick your eye and gain your trust.

“Be careful what you download. Never open an email attachment from someone you don’t know, and be wary of email attachments forwarded to you. Set up two-factor (or multi-factor) authentication on any account that allows it, and never disable it,” the FBI noted.

Similarly, it advised people to be careful with what information they share online or on social media, stressing that, “By openly sharing things like pet names, schools you attended, family members, and your birthday, you can give a scammer all the information they need to guess your password or answer your security questions.”

Malware

Malware is software designed to disrupt, damage, or gain unauthorised access to a computer system.

Google Ads Help revealed that malware can steal sensitive information from people’s computers, gradually slow down their computers, or even send fake emails from people’s email accounts without their knowledge.

To prevent malware, Google suggested that you “Keep your computer and software updated. Use a non-administrator account whenever possible. Think twice before clicking links or downloading anything. Be careful about opening email attachments or images. Don’t trust pop-up windows that ask you to download software. Limit your file-sharing and use antivirus software.”

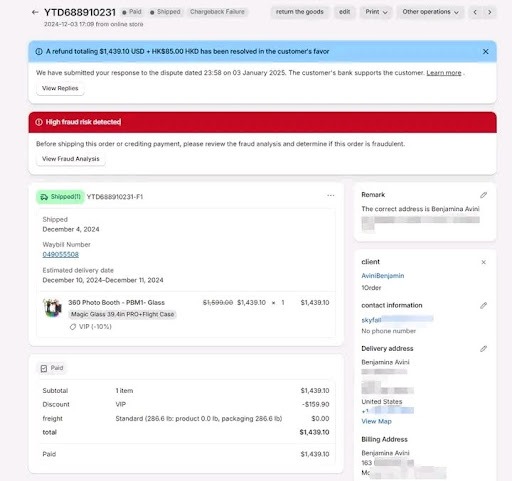

Invoice Fraud

Invoice Fraud is a type of financial crime where someone sends a fake or altered invoice to a business to get them to pay. The goal is to trick businesses into thinking they are making a legitimate payment.

According to ActionFraud, “Fake invoice scams happen when fraudsters send an invoice or bill to a company, requesting payment for goods or services.

Receipt Scam

Receipt fraud involves stealing or falsifying receipts for a refund or other benefit.

It can involve returning stolen items, even items to a different store for a higher price, adjusting customer records in exchange for incentives, and stealing cash or checks.

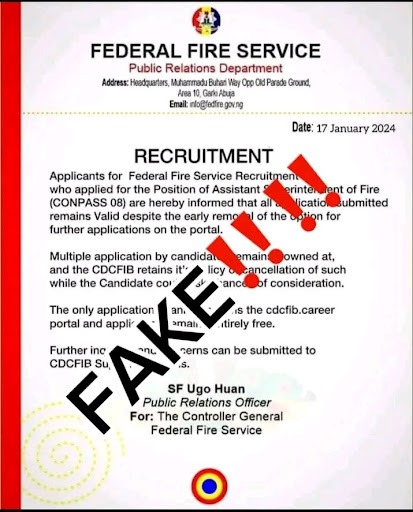

Fake Website

Scammers create fake websites that resemble legitimate sources.

Fake Offers

Scammers make false promises about products, services, or investments to deceive and scam people.

For instance, a Facebook page in 2020 named “M.T.N Lockdown Giveaways – Kingdom”, which advertised phone, car, and laptop giveaways for students, is an example of fake offers people should watch out against.

To avoid receipt fraud, fake websites, and fake offers, verify the authenticity of transactions and websites by checking URLs, looking for HTTPS, and researching the seller’s reputation. Be cautious of suspicious emails or messages with spelling errors, generic greetings, or urgent calls to action. Use secure payment methods such as credit cards or PayPal, which offer buyer protection. Monitor your accounts regularly for unauthorised transactions and report any discrepancies. Also, be wary of offers that seem too good to be true or require upfront payments.

Watch Out for These Red Flags – Online Coaches

Explaining how to avoid falling victim to fake ads and websites, a digital media expert, Mr Obi Kingsley, said most online businesses are fake, advising that real platforms do not ask people to pay before earning.

“Real money-making websites or apps will not come to your Direct Messages or post unverified ads on social media to lure people to their websites. Rather, they will advertise their business through social media influencers or credible news platforms,” he said.

Another online business coach, Olivia Onochie, acknowledged that not all online businesses are scams.

She, however, noted that any unverified ads on social media that direct people to social media group chats to exchange small amounts of money for a huge income are scams and fake.

“Anyone or website that directs you to where you will use your money to play Sporty bets or gaming stuff is a scam. Tons of people have fallen for it,” Onochie added.

As advised in a study published in the Journal of Applied Security Research, titled “Fraud in Online Classified Ads: Strategies, Risks, and Detection Methods: A Survey,” Internet users should “not deposit money on any website or app without a thorough investigation.

“Avoid unverified social media ads asking to deposit money entirely, even if you want to go into online business, get yourself an experienced coach. Someone you know very well. Enable MFA.

“Multi-factor authentication (MFA) is a security measure that requires you to provide additional forms of authentication.”